Carnival Australia is set to release its 2026/27 itineraries this month – the first which will take into account two ships from P&O Cruises Australia, which will be transferred by the beginning of the year.

But there are already clues to the consequences of the changes – particularly in Australia’s regional ports, where many communities like Eden have invested heavily in the future of cruise tourism.

According to the port schedules around Australia, where future ship calls are recorded, it appears that Carnival will only look to homeport ships in Sydney or Brisbane. This means that interstate cruisers will have to fork out thousands more to cruise, and regional ports will get fewer visits from home-based brands.

P&O’s Pacific Explorer was previously deployed to sail Australia and New Zealand’s coastlines. Before it retires in 2025, Pacific Explorer will homeport a large range of cruises out of Melbourne, Adelaide, and Fremantle. In just a couple of months the ship will visit ports like Kangaroo Island, Port Arthur, Dunedin, Lautoka, Suva, Hobart, Exmouth, Lombok, Langkawi, and Singapore.

Pacific Explorer also frequently made stops at regional ports such as Geraldton, Port Lincoln, Eden, Darwin, Norfolk Island, and more. However, the real kicker is that it would homeport out of multiple cities across Australia and New Zealand, offering more cruisers the chance to cruise from their doorstep.

Currently, however, Carnival only sails out of Sydney or Brisbane. The important question, now that the corporation has sunk its 92-year-old Australian brand, is whether the line will use one of its two P&O ships to sail out of, and to, a larger variety of local ports.

The other reason is that Australia has been seeing a broader oligopoly of home-ported cruises, with nearly all large ships now sailing out of just Sydney and Brisbane.

This has been compounded by many lines withdrawing from Melbourne, where cruises could often visit South Australia. Furthermore, Princess, which was once based in Adelaide, is now reducing its fleet and has removed a South Australia homeport. Princess currently has lots of scheduled stops around Australia, however, after having four ships here last season, by 2025/2026 it will have just two.

It appears that Carnival will continue to prioritise cruising out of Sydney and Brisbane, rather than sending a new ship out to homeport out of other ports in Australia.

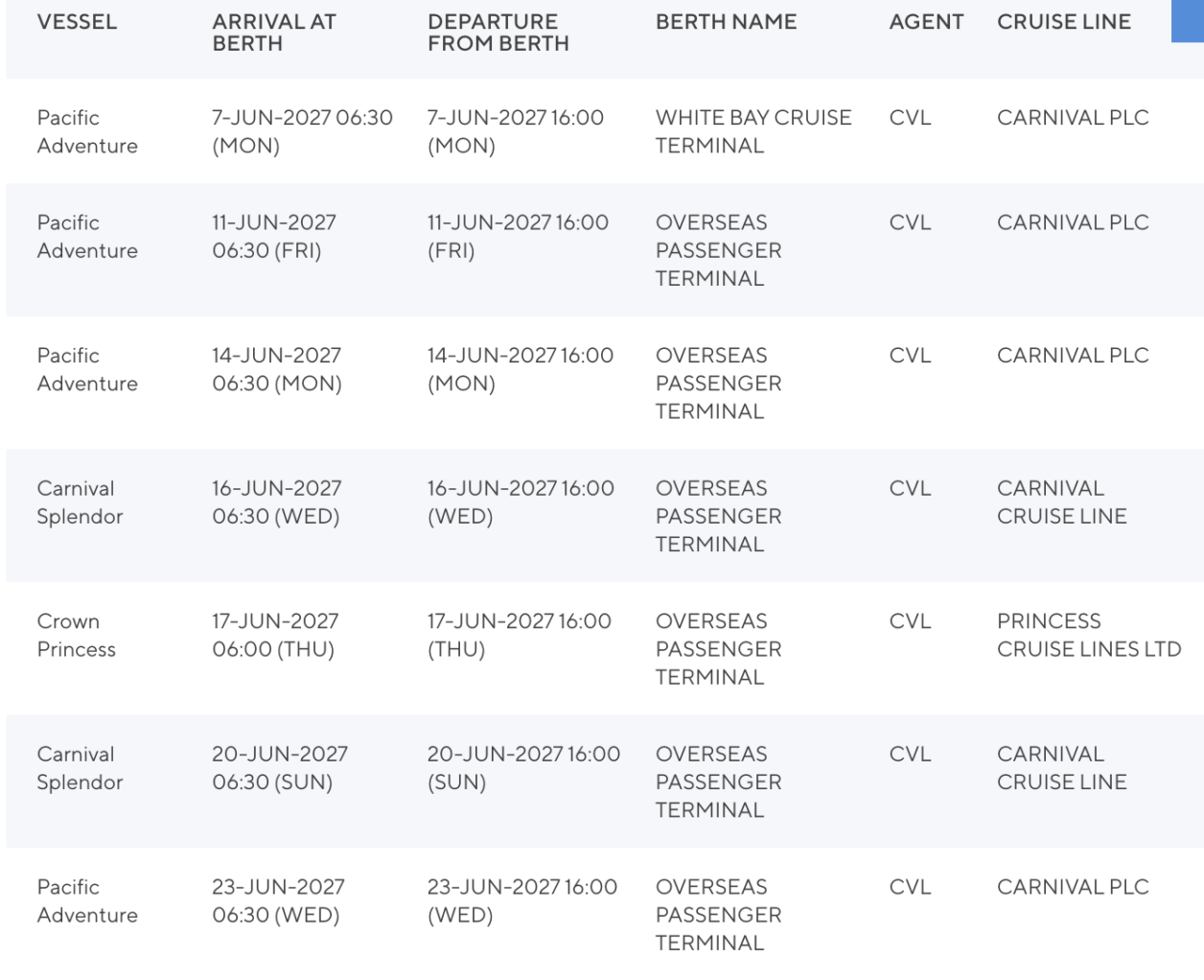

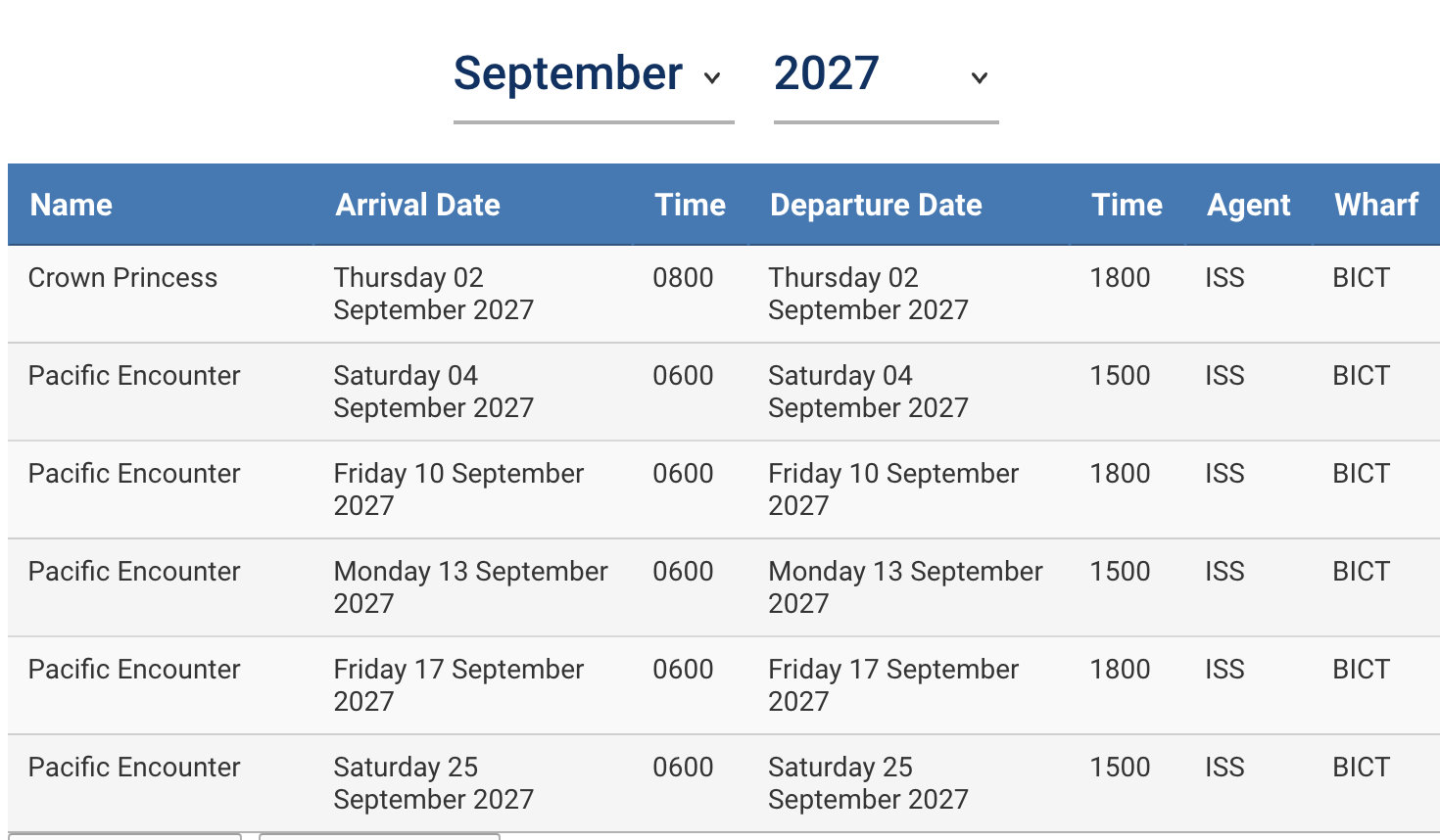

Forward schedules offer a clue

The port schedules below show both ships are scheduled to stick to homeporting out of their respective cities well into 2027.

Pacific Encounter will homeport out of Brisbane and Pacific Adventure will homeport out of Sydney. It’s currently unknown how much variety their new itineraries will have from current Carnival itineraries. This is according to publicly available cruise port schedules, the itineraries have not been officially released.

Forward bookings to Melbourne, Adelaide and Fremantle are yet to show anything, but this is standard for cruises so far ahead of time.

For example, current Carnival itineraries have nothing listed to Western Australia or South Australia, both areas frequented by Pacific Explorer. Royal Caribbean also doesn’t visit these states, meaning that if Carnival’s newer itineraries don’t visit them, the two states will be left with only occasional calls from Princess Cruises.

The consequences

There are major impacts both for consumers and ports. For consumers, this will mean all willing cruisers who don’t live in Sydney or Brisbane will have to get return flights for their Australian cruises. This represents a major barrier to entry for an extremely popular and economic family holiday, with Australia making up the world’s fourth-largest cruise market.

While cruising is loved for many reasons, its value for money is certainly high up on the list, and it doesn’t look quite as enticing when you add flights, hotels, transport, extra meals, and more.

This could have the effect of pushing more Aussies to cruise overseas, something major cruise lines are now pushing hard.

Cruise Passenger has previously calculated that for someone living in Perth, it can be cheaper to head across and cruise in Singapore than to Sydney.

Cruise Passenger has also previously calculated that those who don’t live in Sydney or Brisbane will likely pay at least $1200 extra for a two-person cruise when factoring in flights and hotels. This figure is before considering other costs like meals, cab fares, post-cruise stays, and more.

Regional ports will see millions in losses

While this signals the impacts on cruisers themselves, ports and their port-town communities will feel the impacts as well.

For example, the Tasmanian port of Burnie will already see the effects this coming season, and those who have been following Cruise Passenger coverage of Australian cruise capacity know the real drop-off is coming next year.

Burnie will see just 16 cruise ships this season, after seeing 24 last year.

West by North West Regional Tourism chief executive officer Gabriella Conti told The Advocate that this will have a severe impact on the region as a whole.

“We are disappointed in the reduction of cruise numbers into Burnie. It’s not only the impact on tourism operators but Burnie businesses as well

“It is important to state that Burnie is one of a number of regional ports impacted by cruise ship calls.”

Business Northwest president Ian Jones also told The Advocate that it’s a worrying trend and will impact local businesses.

“Cruise ship business is the icing on the cake – it’s not their core business but it’s also valued.

“But tourism places like the rhododendron garden and Wings Wildlife Park lose a lot of patronage because of the reduction in numbers.”

Jones noted that when large ships stop visiting regional ports, this represents significant losses.

“Ships like that have 2500 to 3000 passengers and when it doesn’t come five or six times, that is a lot of passengers out of the system.

“You can’t quantify in dollars or percentages but if tourists spend $300 or $400 on business, it’s business you would not have got if the ship hadn’t come in.

“One of the downsides for me is it decreases the vibrancy of the CBD.

“There is a real vibe there when the tourists are in and Burnie has a tremendous reputation for looking after our tourists and the locals get something out of it by talking to people from places many of us have never been.”

Cruise Passenger has also been covering the impact of diminished regional cruising on the Port of Geraldton. A town that has explicitly expressed its disappointment at the lack of cruise traffic that will be coming its way.

The closure of P&O Australia contributed to 12 ships cancelling their planned itineraries to Geraldton, costing the local economy millions of dollars.

Even just months after P&O announced the end of its Australian operations, we are already seeing ports suffer, and if new itineraries don’t include a wide diversity of port visits, the issue will only worsen.

Will Australia lose local cruisers to overseas?

Norwegian Cruise Line used to be a homeporting force in Australia, but with rising costs and tiresome government regulations, it instead has a new focus.

NCL now rather wants to attract Aussies overseas to cruise.

Norwegian Cruise Line vice-president and managing director Asia-Pacific Ben Angell is calling for Aussies to get on a plane and cruise overseas, rather than cruising locally.

While this is likely a smart business decision by NCL, for the Australian economy, there’s a significant difference between Aussies jumping on local cruises where their dollars are distributed between local business operators and suppliers, and taking their money overseas to places like Europe and Asia.

Cruise lines targeting fly cruisers would come at a time when Aussies who don’t live in Sydney and Brisbane will be particularly open to the idea, as they’ll have to fly domestically anyway.

Angell says: “Whilst there are undoubtedly challenges in the local cruising sector there is an almost uncapped opportunity for growth in the Fly Cruise market.”

This is highlighting the problem, that regulatory issues and costs are making Australia an unattractive destination for cruise lines to bring their big ships. The issue lies there, not at all in demand or customer satisfaction, Aussies want to cruise.

Angell continues: “In 2023, 85 per cent of Aussies who cruised did so within Australia, New Zealand, and the South Pacific. Just 200,000 cruised in other parts of the world. This versus 10 million Australians who travelled overseas in 2023, of which some 5 million-plus are travelling for leisure.”

My name is pat my husband and l live in Melbourne we have cruised all around the world mostly on princess we are very disappointed nothing is coming out of Melbourne we do not want to fly to other states as we are now nearly into our 80’s and it’s more convenient to go from Melbourne we have thoughrly enjoyed all our cruises and hope that the cruise lines come back

I have found any previous cruises from Fremantle WA were always a lot more expensive per day than those leaving from Eastern States. West Aussies are already used to that extra cost of flights and accommodation for better value for $ costs cruising from ES.

As a West Aussie, my dream is for cruiselines to open up the Singapore–Fremantle route as this offers huge opportunities for travel to and from Asian countries.

There are only so many times one wants to limit cruising to the South Pacific, New Zealand and of course, Eastern States of Australia. Just saying…

I would like to know why more cruise lines don’t leave from Adelaide their are a lot of people in Adelaide can’t or are not able to fly to

Sydney or Melbourne expense wise first and health reasons. It would make more sense to be able to cruise frk m Adelaide.. I think you would

Be surprised at the number of people who would appreciate that suggestion of being able to cruuse from Adeaide i myself and husband

Who have sailed quite a few trips would like not to have to fly to leave other ports for our trips regards Mrs Y Kennedy

We loved having Pacific Explorer in NewZealand Wish our Government would buy it .Going on it 10th of October Comedy Cruise.love the ship and staff

Good article and stating the truth

As a well travelled cruiser it looks as though my cruising from Australia is coming to an end.

A cruise from an overseas port is easier than a cruise from Sydney as I live in Melbourne

Just goes to show how greed by a big corporation like Carnival can destroy an established nearly 100 year old company which has been the main choice for decades for Australian cruisers. The flow on effect will surely cause some small business operators like tour guides to close up entirely whilst larger cruise ship suppliers will see there sales decimated.

I think it’s ridiculous a lot of people can’t fly for whatever the reason , cruising around Australia was great for those also that didn’t have passports, Pacific Explorer is an amazing ship I went last year from Perth to Exmouth I was booked again to go in their comedy cruise but due to carnival taking over this was cancelled so we’ve had to move forward closer to beginning of 2025 and now we are going back to Exmouth again which is a great cruise I think it’s terrible that they are getting rid of the Australian piano surely somebody with brains could overtake the Pacific Explorer and keep that for Australia only that way for all the people that want to travel just around Australia that ship would have been perfect keep it in Australian waters for just travelling around Australia I believe the Pacific Explorer often did cruises to Busselton Carrollton Exmouth and around the other side why does somebody not buy that ship instead of decommissioning it so much for spent on it Just recently when it transferred from the Dawn Princess to the Pacific Explorer I’m sure it is still in good running condition It should be kept in Australia as as Australia’s own ship and be used for just going around in Australian Waters only There is a lot of people that can’t fly and can’t afford to go on all the expensive cruises or to other countries to be able to get on a cruise bad move There needs to be a cruise ship for Australia. The government should step in and use this P&O explorer totally for just Australian cruises only. It seems like nobody cares especially about western Australia everything’s always been about Sydney Brisbane and the East coast.

Pacific Explorer is a beautiful ship The staff that we have come across were amazing The ship itself is amazing I hope that she’s not decommissioned and that somebody buys her and continues using her as a solely Australian ship only fingers crossed for all of those that can’t fly and enjoy what the Pacific Explorer has to offer

Wait until we see the Princess Cruises itineraries for the same period. Already talk that Australians should travel overseas to catch a cruise.

Almost as if the cruise industry is in its death grips.

The other problem is the age of the old P&O cruise ships being moved to Carnival. How long will cruisers accept the quality of these ships?

It is been more than obvious since it was announced that P&O was to be swallowed by Carnival that all regional ports would be missing out. Nor does carnival care that the regional cruisers can expect to add up to $2000 to their cruise expenses.