Cruisers will see higher prices according to Harry Sommer, the President and CEO of Norwegian Cruise Line Holdings.

But most see the value in cruise. Others…not so much.

“We’re not out to nickel and dime people,” said Sommer, speaking to Cruise Passenger in Europe for the announcement of a new genre of ships.

“We want to give people fair value for their money, but we have found people who have spent the most money have the best time. Every once in a while, you’ll have a guest who books an inside cabin, never takes a shore excursion, and goes to the buffet every single night.

“They then pay their gratuities and walk off the ship with zero dollars spent on their bill. But they aren’t a happy cruiser.”

Sommer’s company earlier this year posted its second-quarter results, which showed a huge increase in onboard spending. There is strong consumer confidence in the three brands under Sommer’s umbrella – contemporary, Norwegian Cruise Line, upper premium Oceania Cruises, and ultra-luxury line Regent Seven Seas.

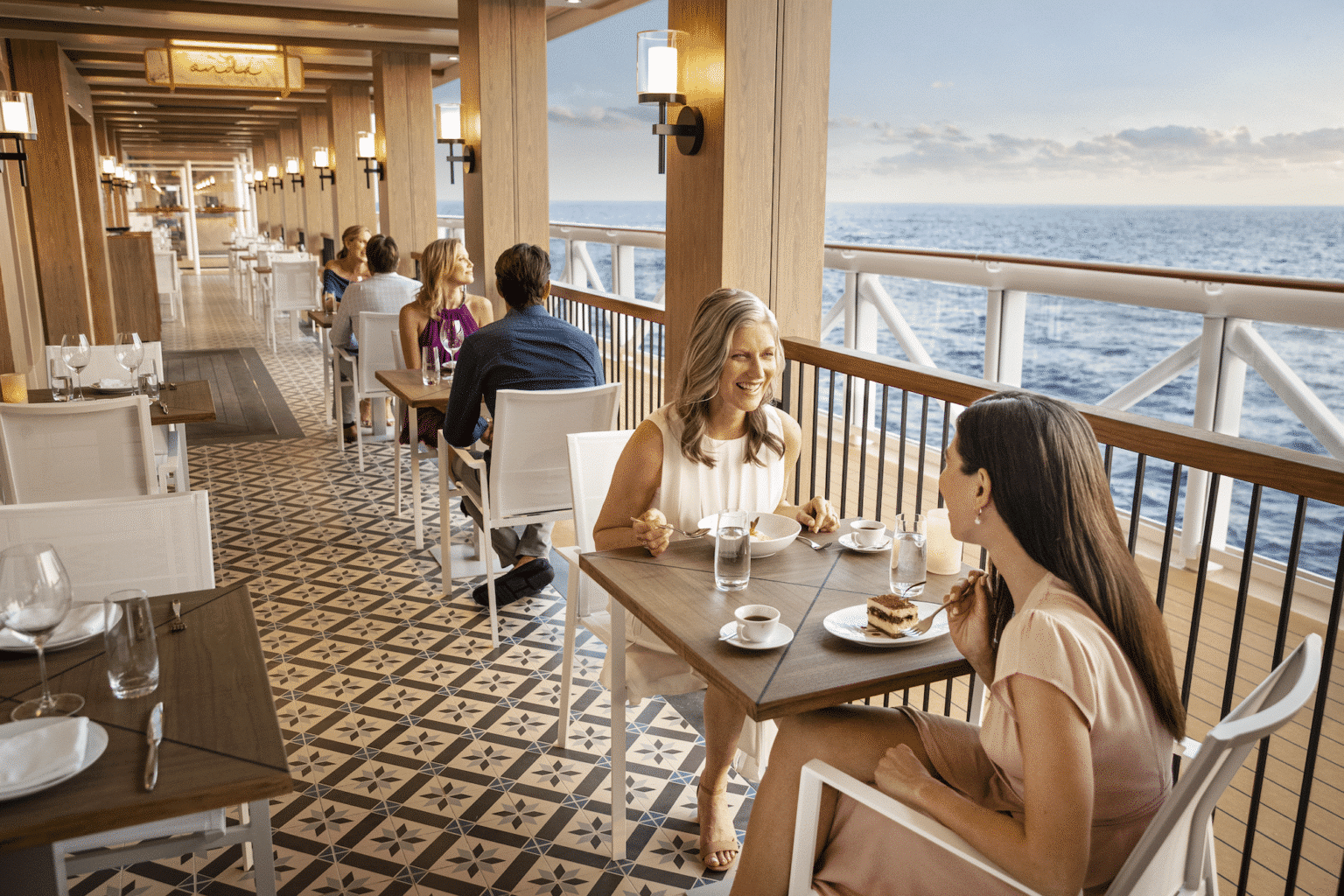

Specialty restaurants, beverage packages, and shore excursion credit have all proved big hits with guests.

Both NCL and Oceania have package options to give value to the cruiser – NCL’s Free at Sea options allow guests to get specialty dining options, beverage packages, shore excursion credits, and WiFi, while Oceania Cruises Your World Included, will include gratuities, WiFi, specialty dining, laundry services and more.

“What we’ve seen generally is that inflation is a problem for everyone. But what we’ve seen especially for the Norwegian Cruise Line brand is that people are still working. They still have a disposable income and travel is a high priority for them,” Sommer said.

“While for Oceania Cruises and for Regent Seven Seas, these consumers are more heavily geared towards retirement, so they have kept up with inflation. But we are not targeting the lower income demographic.”

Sommer said that guests are booking at least six to eight months in advance, and while Europe is still the number one destination for Australians, the company is looking further afield for the fly-cruise market.

“Europe is their biggest, is the single biggest market for Australia. We usually have eight or nine ships sailing the region. We offer 14-night cruises for NCL which tends to appeal to Australians the most.

But while costs are increasing, and cruisers are happy to pay, Sommer said they are still looking for value. Across the three brands, they now all offer pre and post-cruise hotel stays adding value for their guest.

“There’s a bit of a trend for guests, I guess across the entire group that they’re kind of looking for that pre and post-hotel stay.

“We’re in the process of making our program a little bit easier across all three brands to modify, to easily allow for that pre or post-cruise hotel.

He also spoke about the value that cruising presents, which he says, more people, like the millennial market, are starting to realise.

“Cruising is a wonderful vacation alternative to hotels. There is a huge gap in value where the price of a cruise is 30 to 40 per cent below hotels.

“The industry shows no signs of cracks and we’re very happy about that. Another advantage I mentioned is the long lead time that consumers have in making their bookings. So, they are paying for their cruises four or five months in advance. And by the time they come on the cruise, that money spent is already paid off by their credit card,” Sommer told Bloomberg.

“They are coming on the ship with a full wallet, ready to spend more, unlike hotels where people don’t stay, other than just for sleep. On the ship, there is so much to do like shopping, the spa, and shore excursions which they arrange through us. So for us, we really get a much larger share of the consumers’ wallet on the ship.”

So if someone books and pays for an inside cabin (double fare if they are travelling alone) on NCL (or any cruise line) and doesn’t buy a beverage package or only eats in the buffet or buys an outrageously expensive shore excursion and then disembarks hasn’t had a great time ? Well let me tell you something Harry Sommer you’ve got it all wrong. At times I have done just that during a few of my more than 120 cruises. Not because I can’t afford it but sometimes because I just like to go to sea, to be on board a ship and don’t need a balcony in winter or don’t drink alcohol, or prefer a small meal and sometimes don’t even go ashore. I’ll avoid NCL in future if thats your business plan/attitude, and I’ll do and pay for just the things that suit me on cruise lines that appreciate my custom for MY always greatly anticipated hard earned vacations.

NCL did not fulfill getting me to Vancouverand so did not get me to my cruise. They kept my $7000+. I guess that is how they profit, not upholding their part,and keeping your money.

I have sailed on all of the contemporary and premium lines in the past few years. I enjoy the experience on NCL, but they by far charge or charge more for things other lines include. Plus their gratuities per day are among the very highest,yet they cut service.